When is the German IFO survey and how it could affect EUR/USD?

The German IFO Business Survey Overview

The German IFO survey for January is lined up for release later today at 0900 GMT. The headline IFO Business Climate Index is expected to rise slightly to 97.0 versus 96.3 previous.

The Current Assessment sub-index is seen firmer at 99.4 this month, while the IFO Expectations Index – indicating firms’ projections for the next six months – is likely to arrive at 95.0 in the reported month vs. 93.8 last.

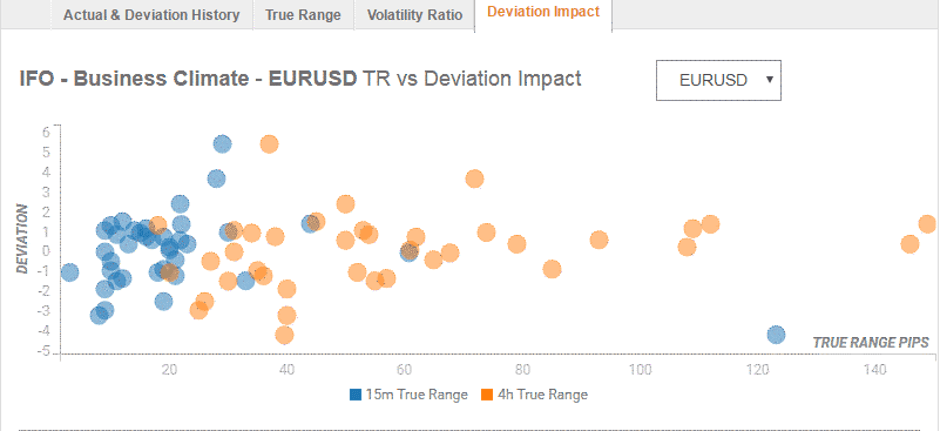

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 40 pips in deviations up to 2.4 to -3.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

According to Haresh Menghani, Analyst at FXStreet, “From a technical perspective, the pair, for now, seems to have stalled the recent downward trajectory near the 61.8% Fibonacci level of the 1.0879-1.1239 positive move. The mentioned support, around the 1.1015 region, should now as a key pivotal point for short-term traders. A sustained breakthrough might turn the pair vulnerable to break through the key 1.10 psychological mark and aim towards testing November monthly swing lows support near the 1.0980 region.”

“On the flip side, attempted recovery moves might now confront some fresh supply near the 1.1060 region (50% Fibo. level). Any subsequent positive move seems more likely to remain capped near the 1.1090-1.1100 confluence region – comprising of 38.2% Fibo. level and a 3-1/2-month-old ascending trend-line support breakpoint,” Haresh adds.

Key Notes

German IFO, headlines regarding corona virus amongst market movers today – Danske

EUR Futures: Bearish view stays unchanged

EUR/GBP Price Analysis: Bulls look for entry beyond 0.8500

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).